Responsibilities

- Studio Leadership

- Build design team

- Manage international team

- Customer & Industry Research

- Customer Journey Flows

- Visual & Design Direction

- User Experience Design

- User Research

- 6 months to market

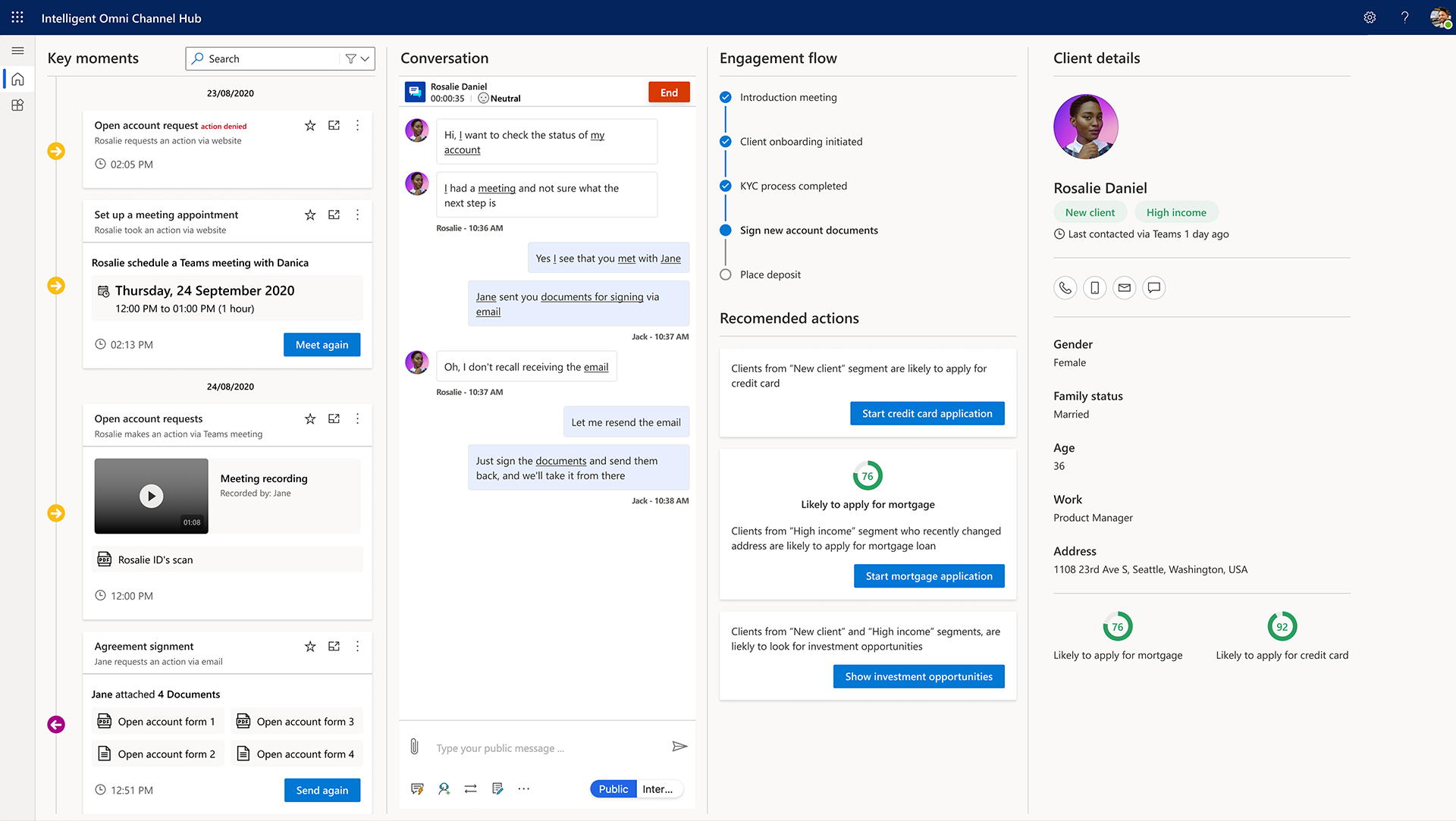

Product UX design for enterprise cloud solutions.

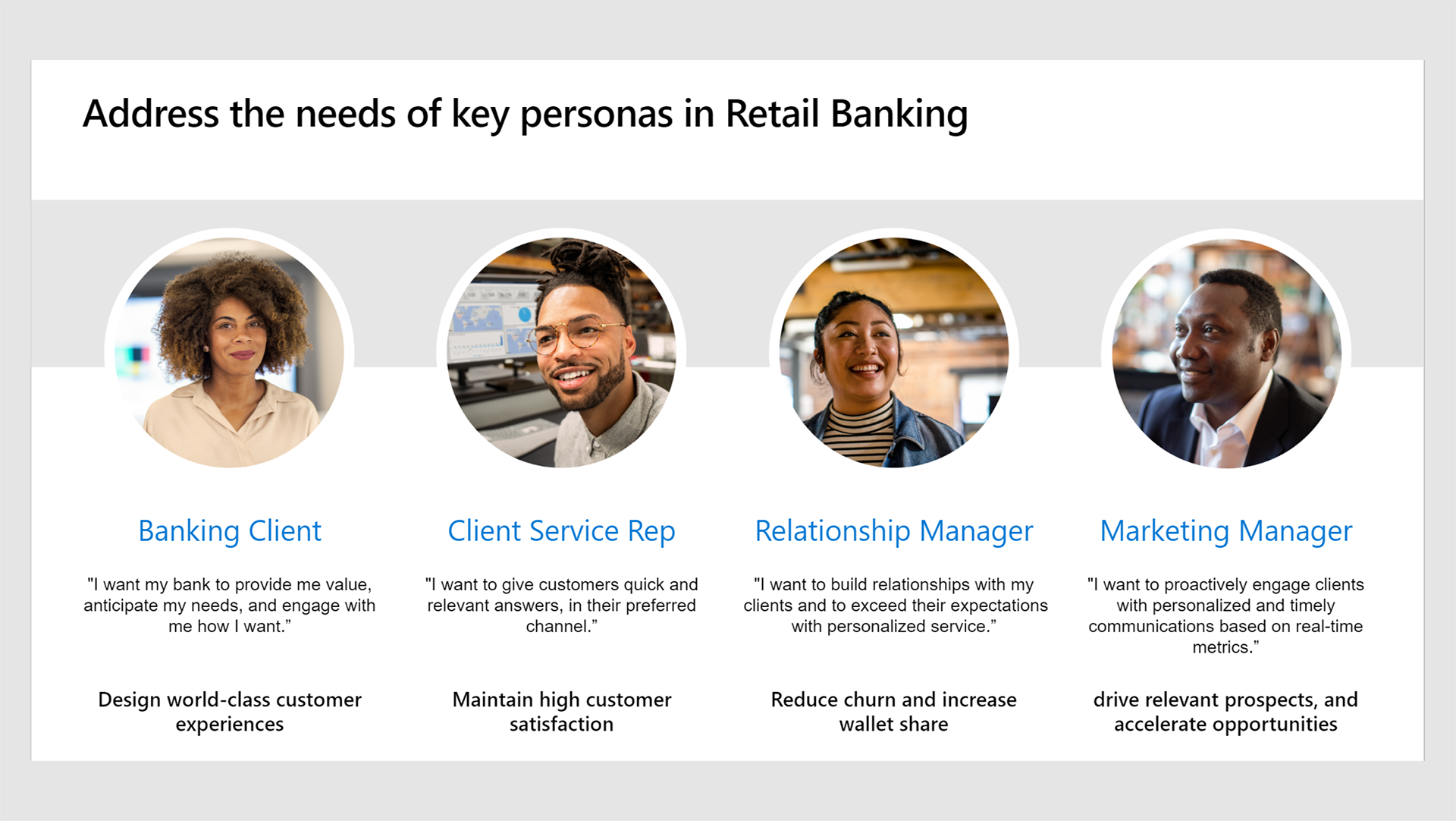

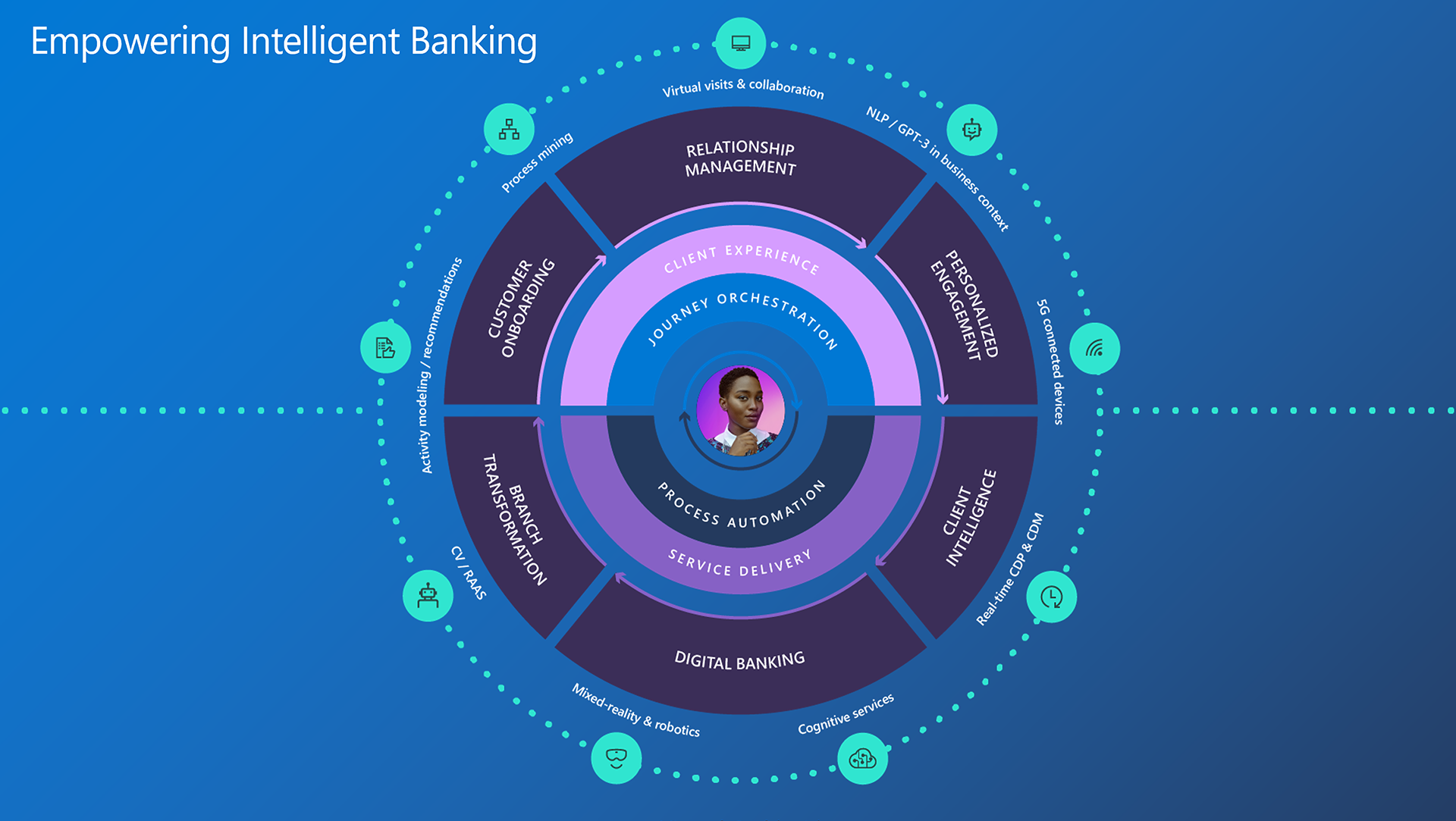

I led the UX design studio responsible for building and launching to market the Microsoft Cloud for Financial Services, an enterprise cloud solution which brings together capabilities with multilayered security and comprehensive compliance coverage to deliver differentiated customer experiences, improve employee collaboration and productivity, manage risk, and modernize core systems.

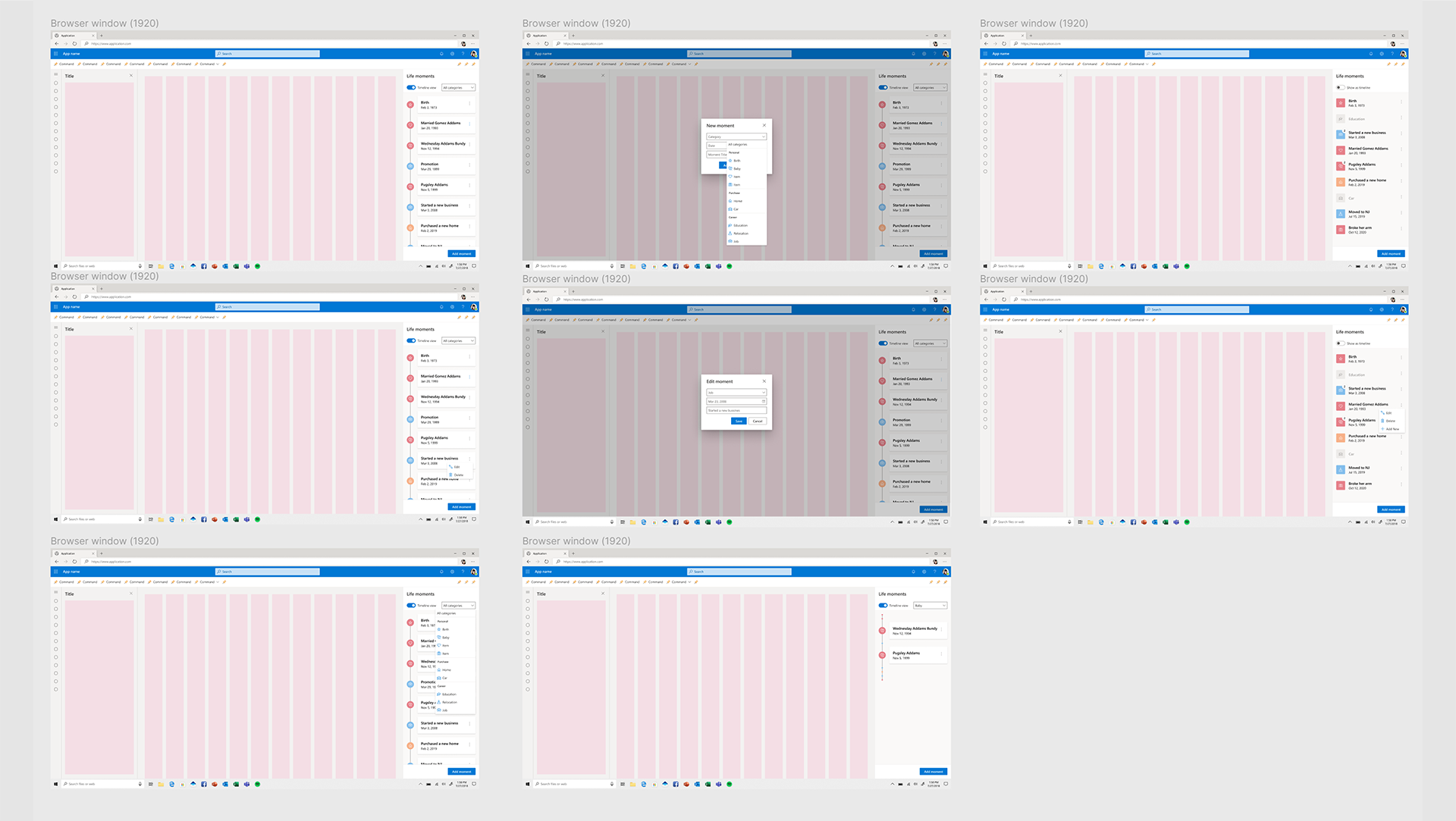

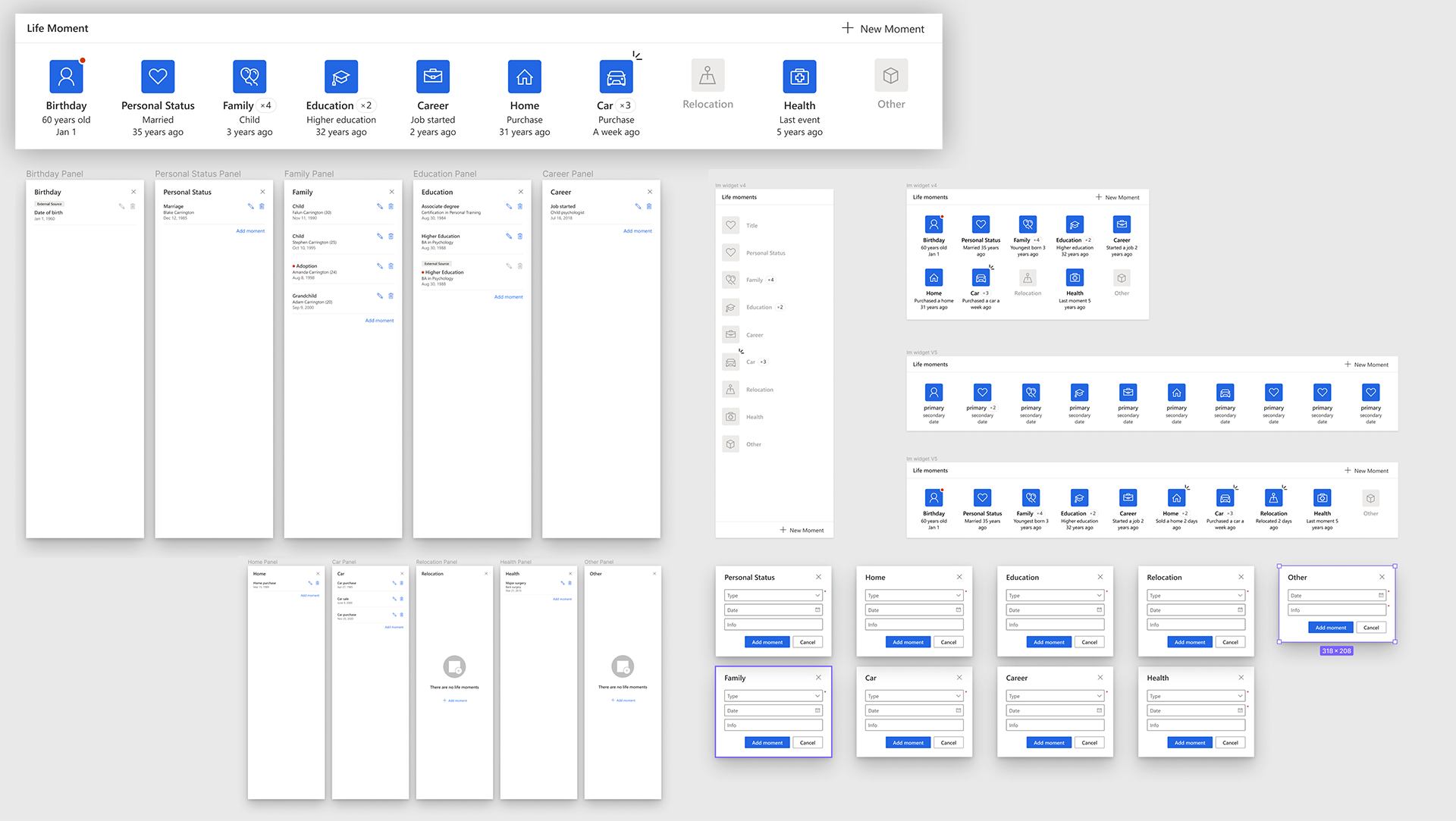

Early explorations, ideation, research and strategy definition.

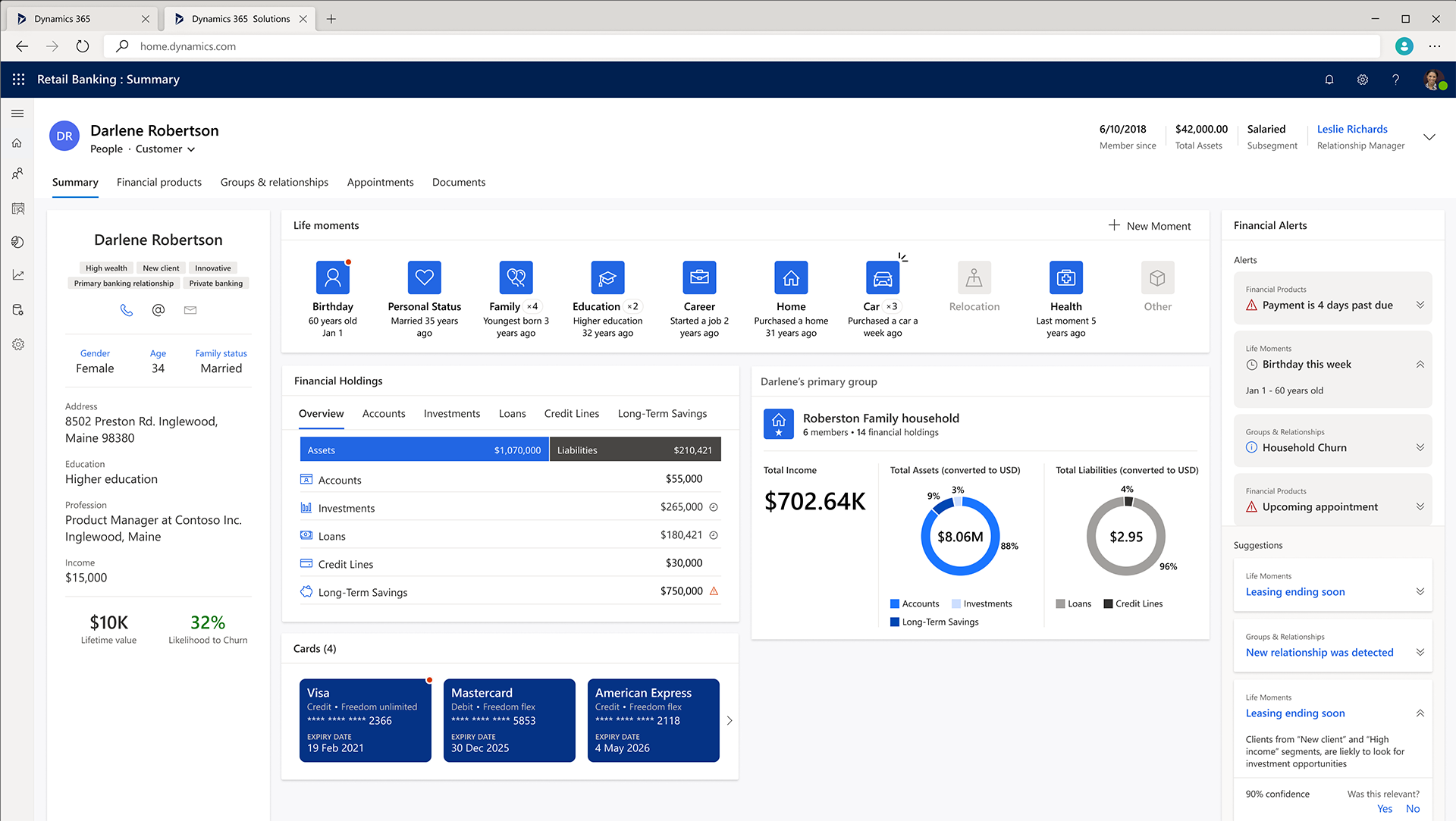

During the initial phases of the project, as I was building and forming the team, we created a number of design studies designed to inform the project stakeholders of the general direction we are considering. Information architecture studies as well as customer and industry research studies were also performed at this time.

A product video designed to articulate the value proposition.

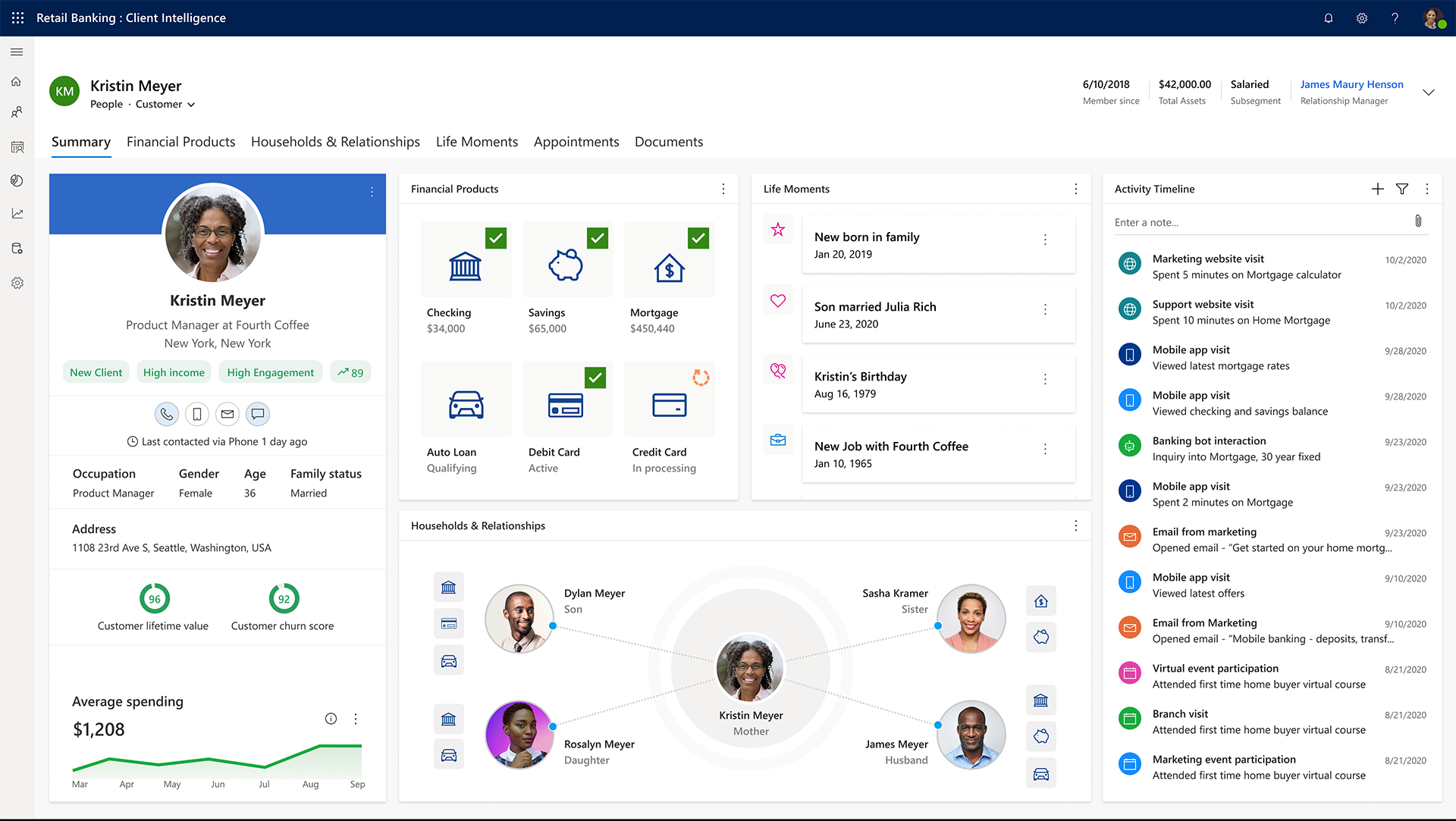

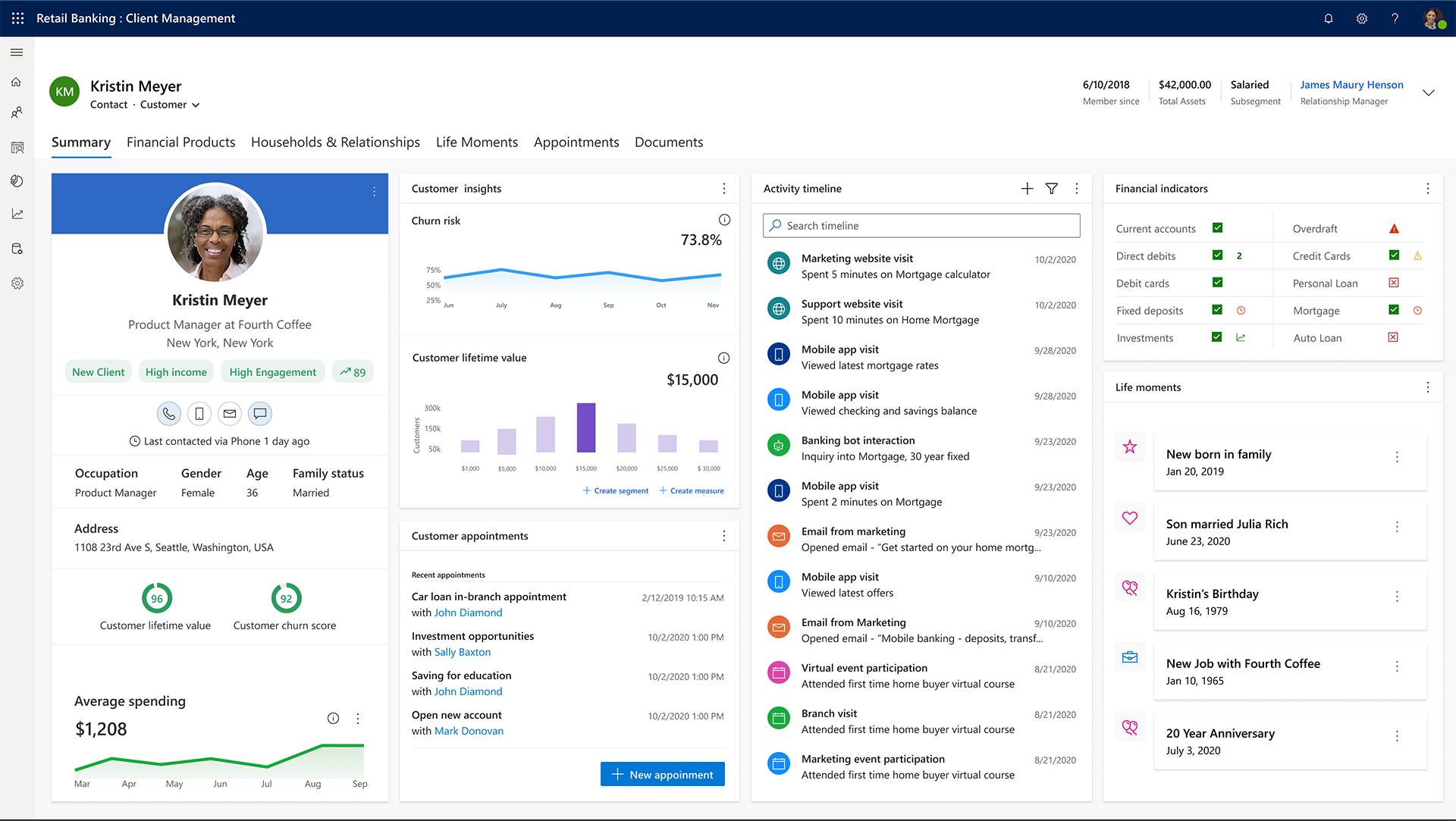

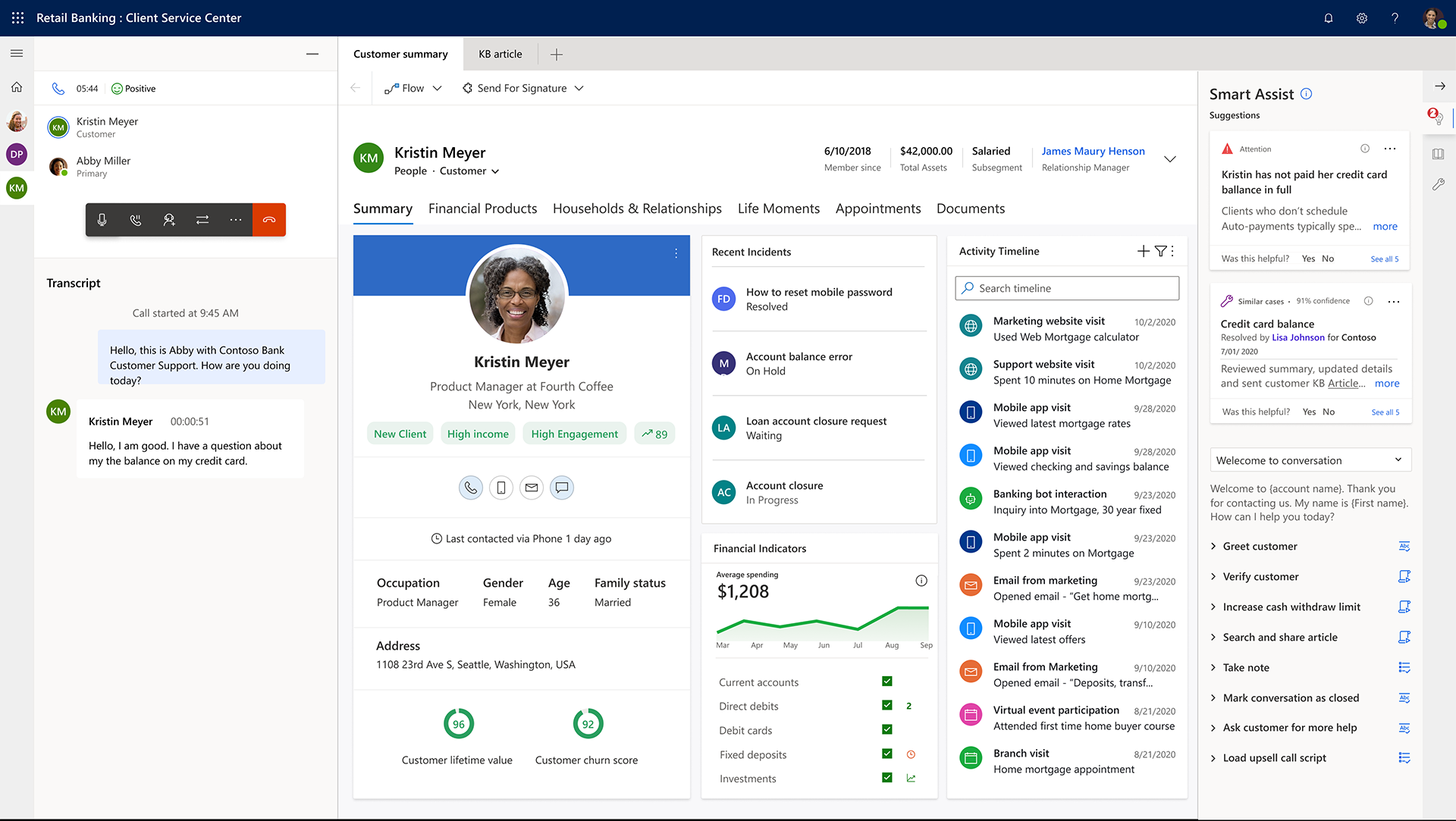

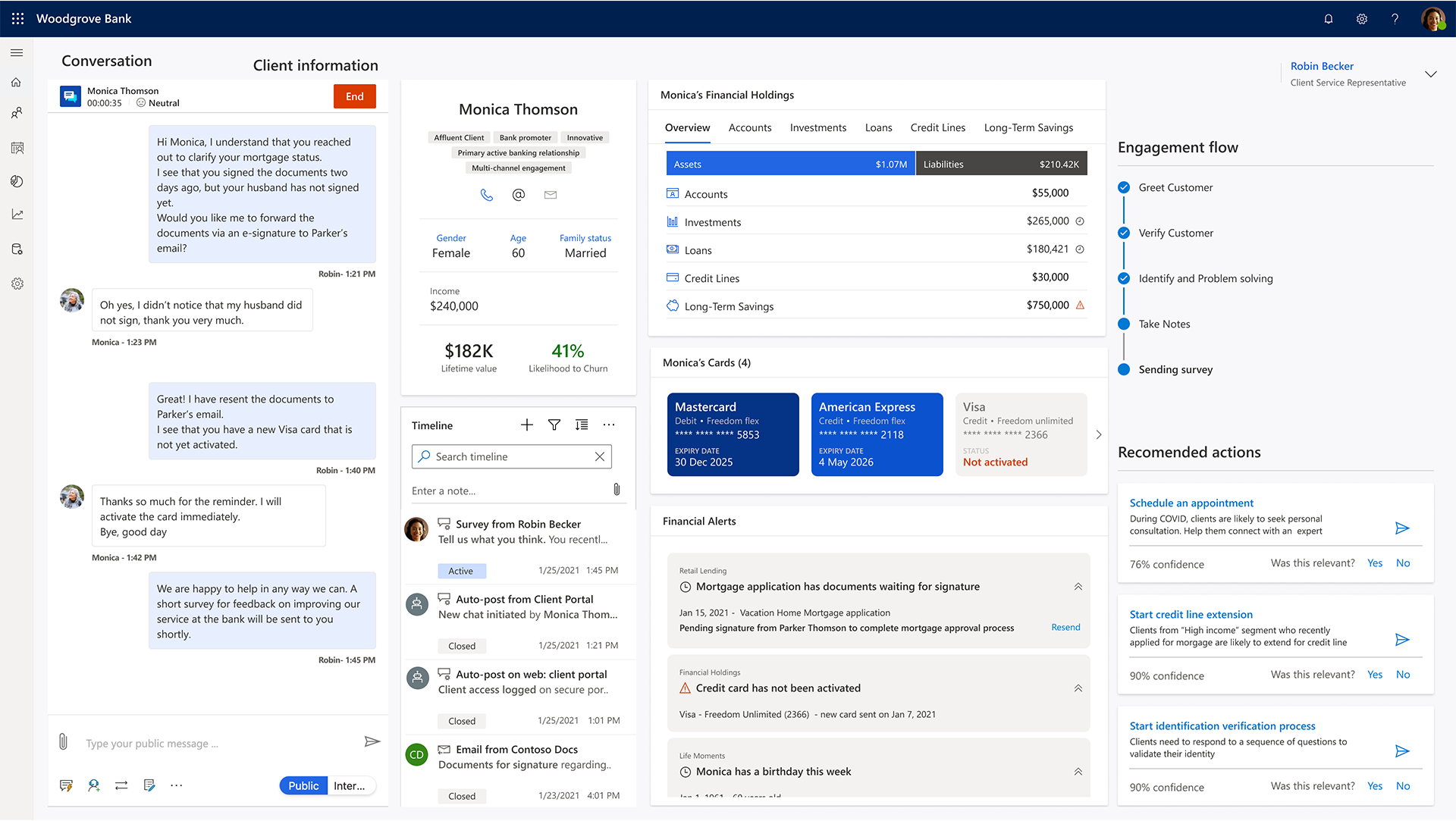

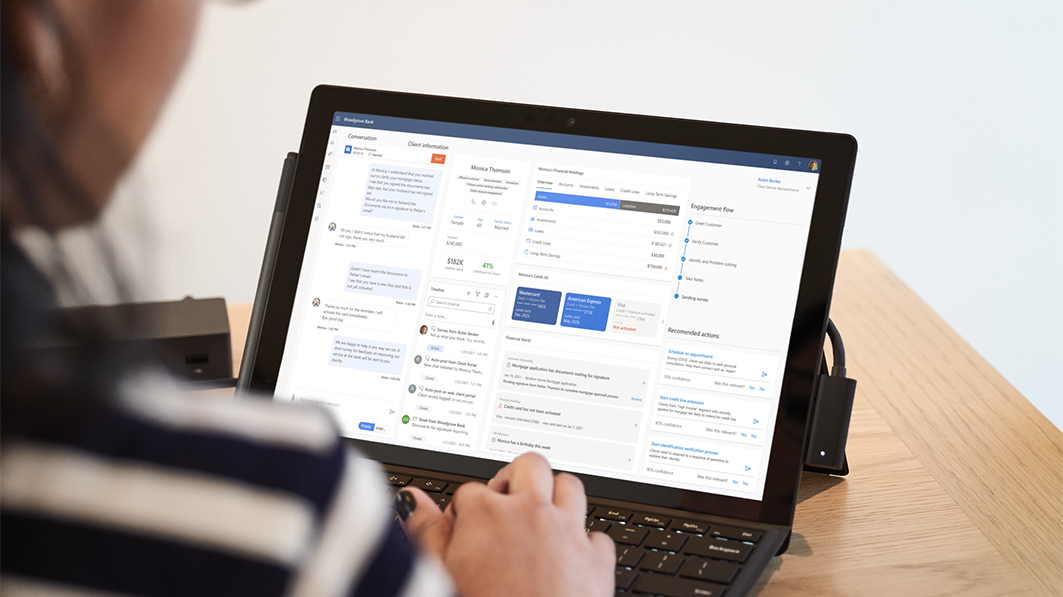

Working with our Narratives team, we created a number of motion pieces to better articulate how bringing together financial, behavioral, and demographic data to tailor customer experiences with a 360-degree view of the banking customer and suggested next actions can result in a future-first retail banking cloud solution that puts to customer at the center.

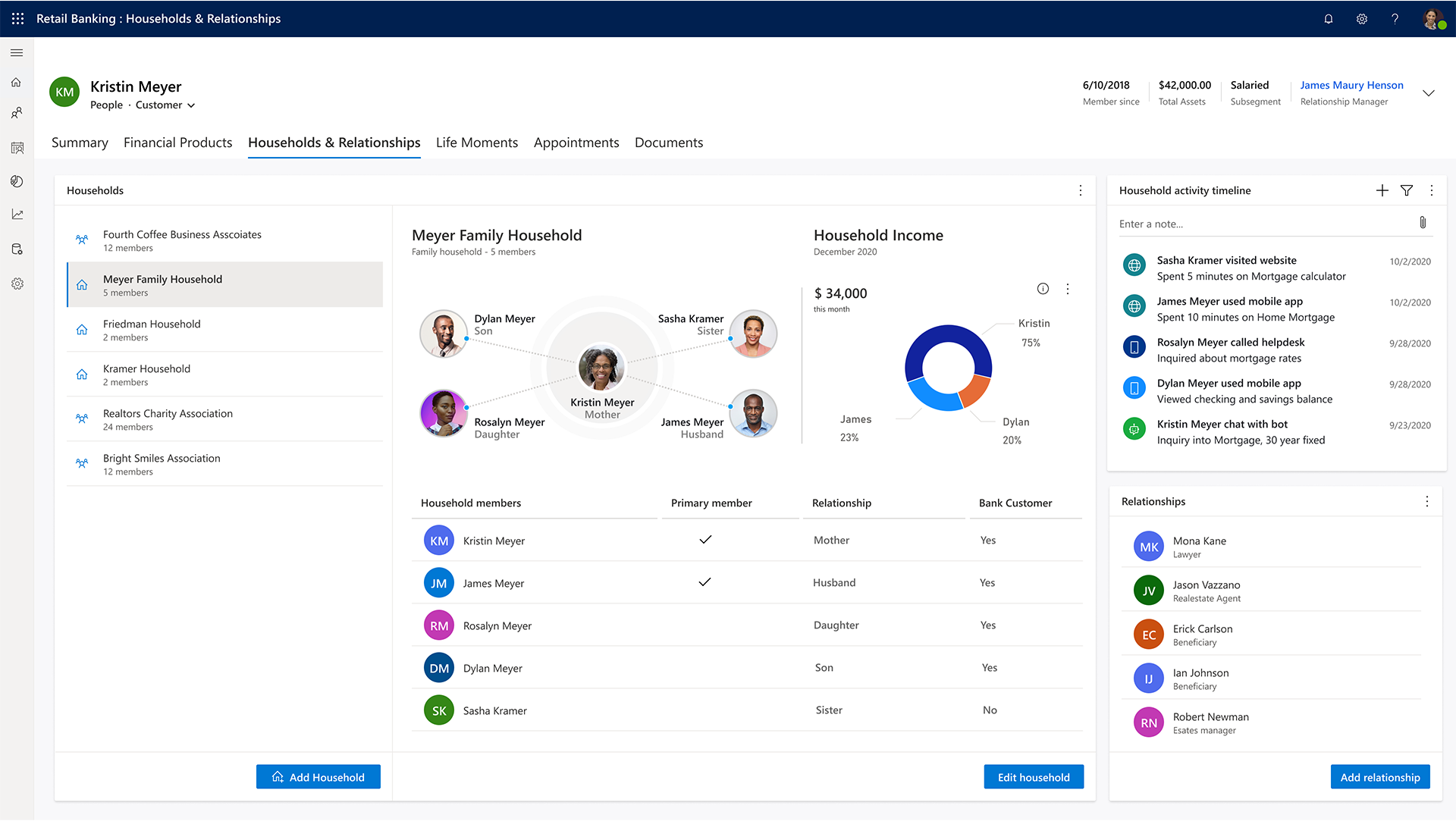

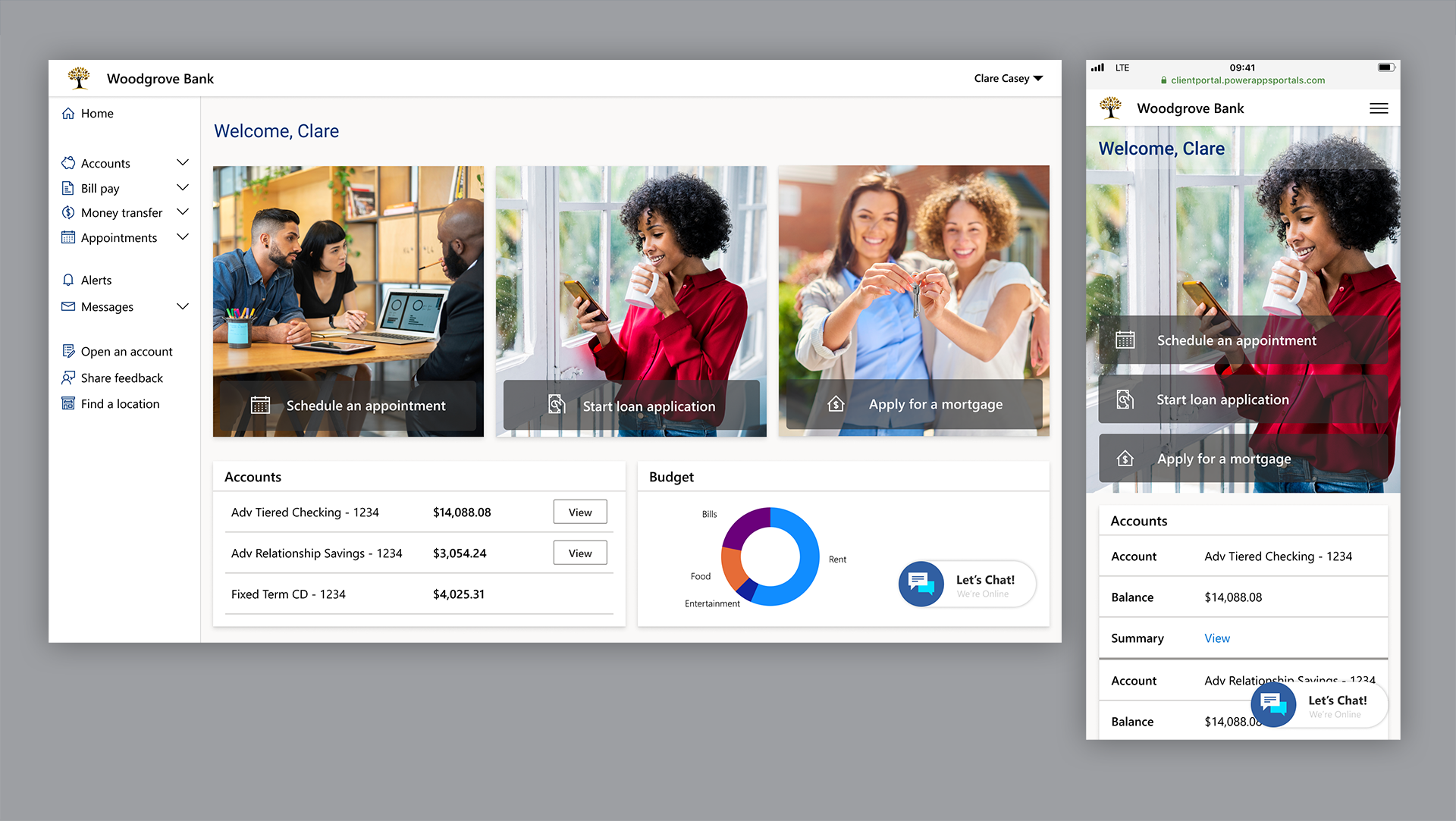

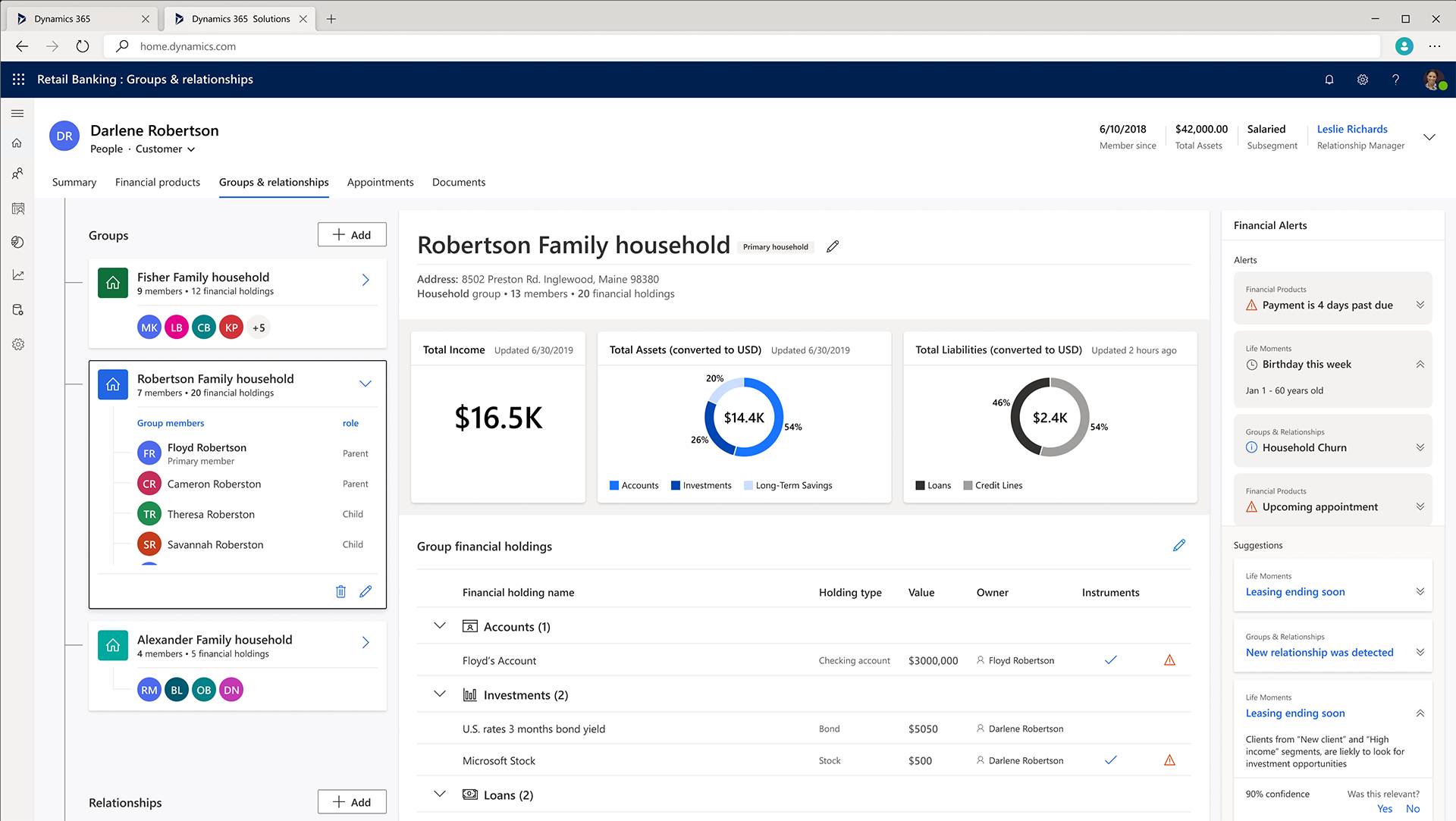

Customer Groups and Relationships

One of the biggest opportunity for any retail bank is to understand the connections and sphere of influence of a customer. This includes the relationships they have and groups they are part of as well as the total assets and opportunities that exists across these groups.

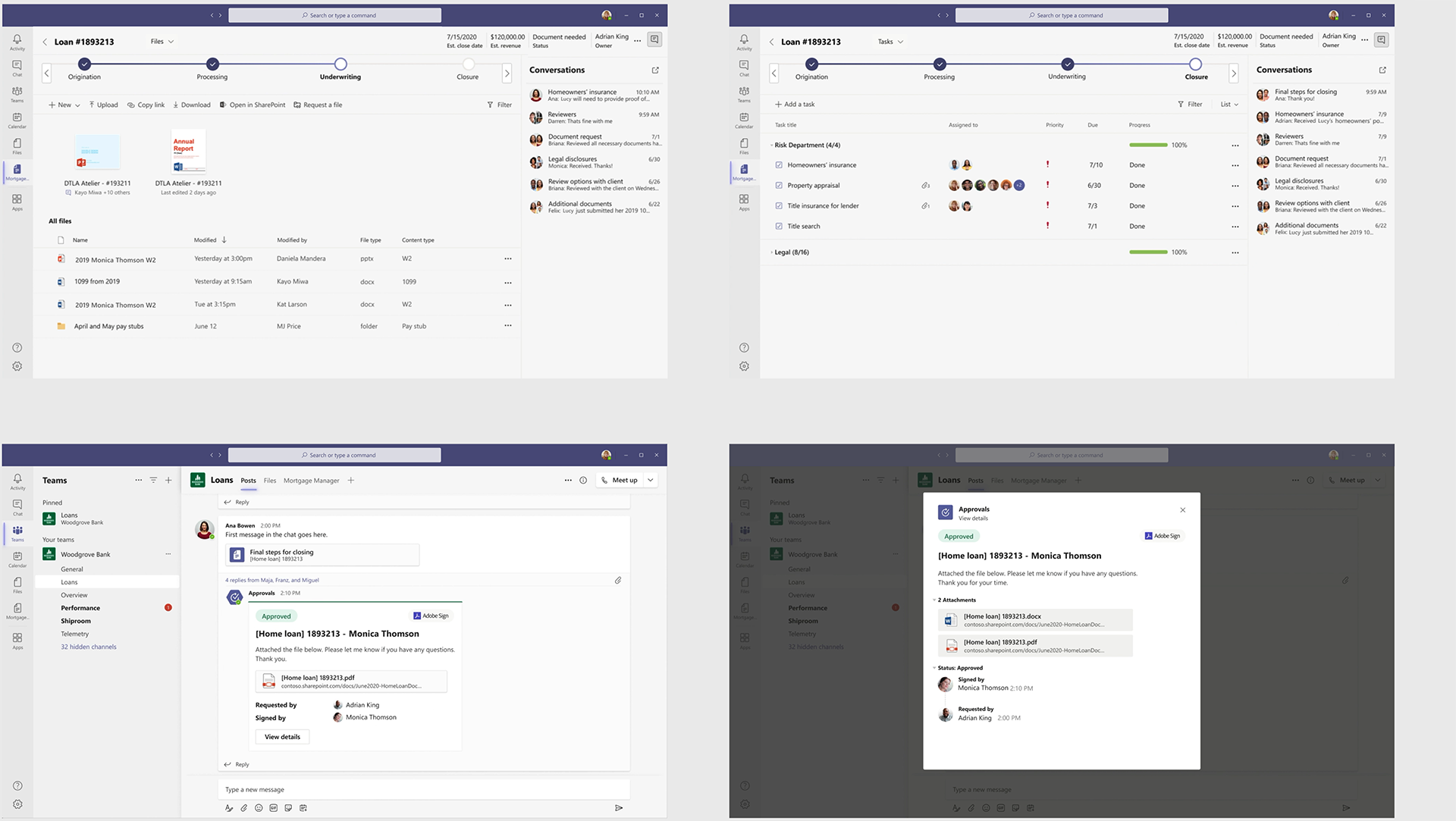

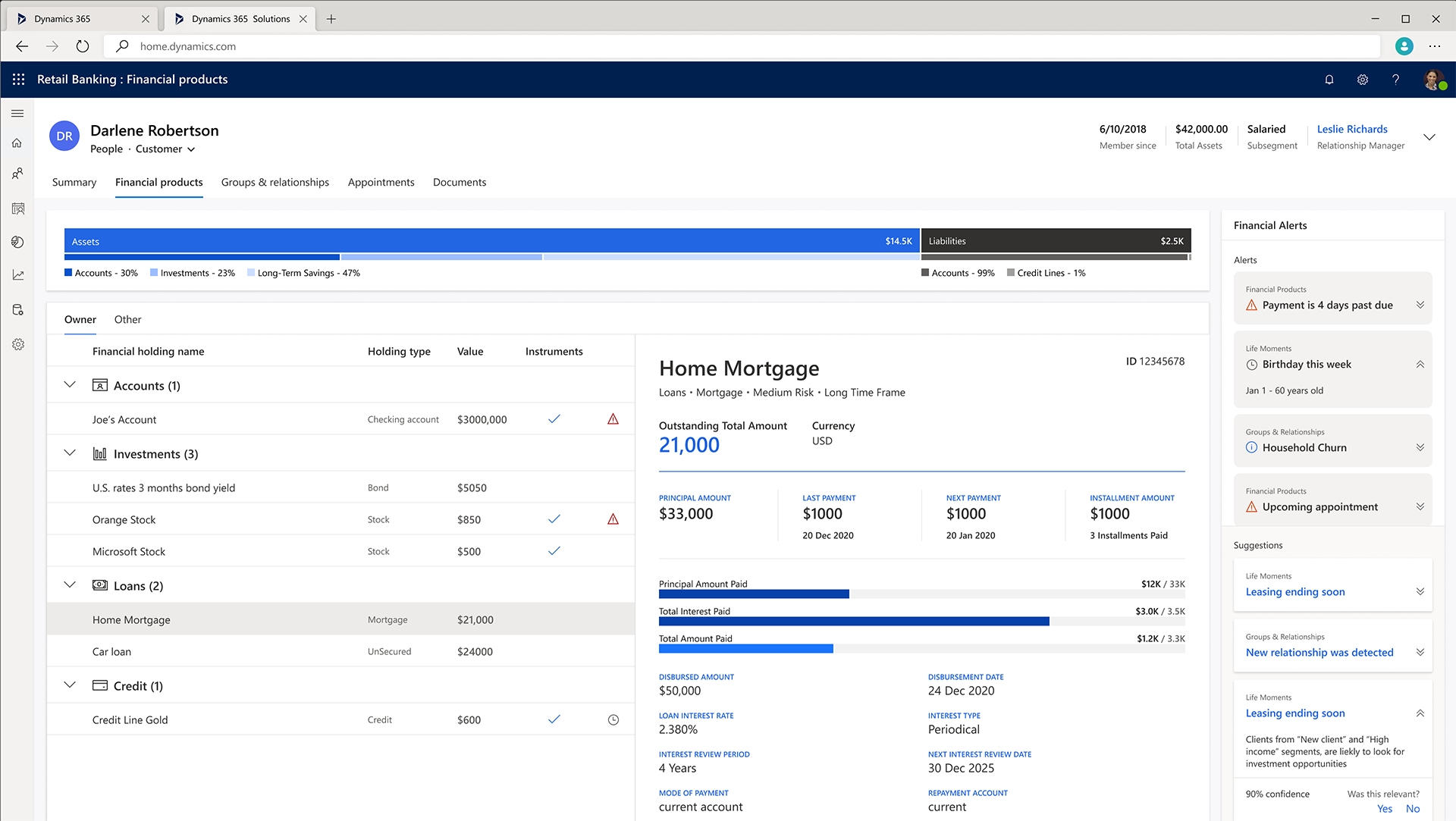

Financial Products

A concise view of all the financial products that a bank customer has allows bank customer representatives and branch managers an opportunity to see all the products that a customer currently has as well as products they would benefit from considering. Relevant notifications are also presented in this view, to assure that the next interaction with the customer is most meaningful.

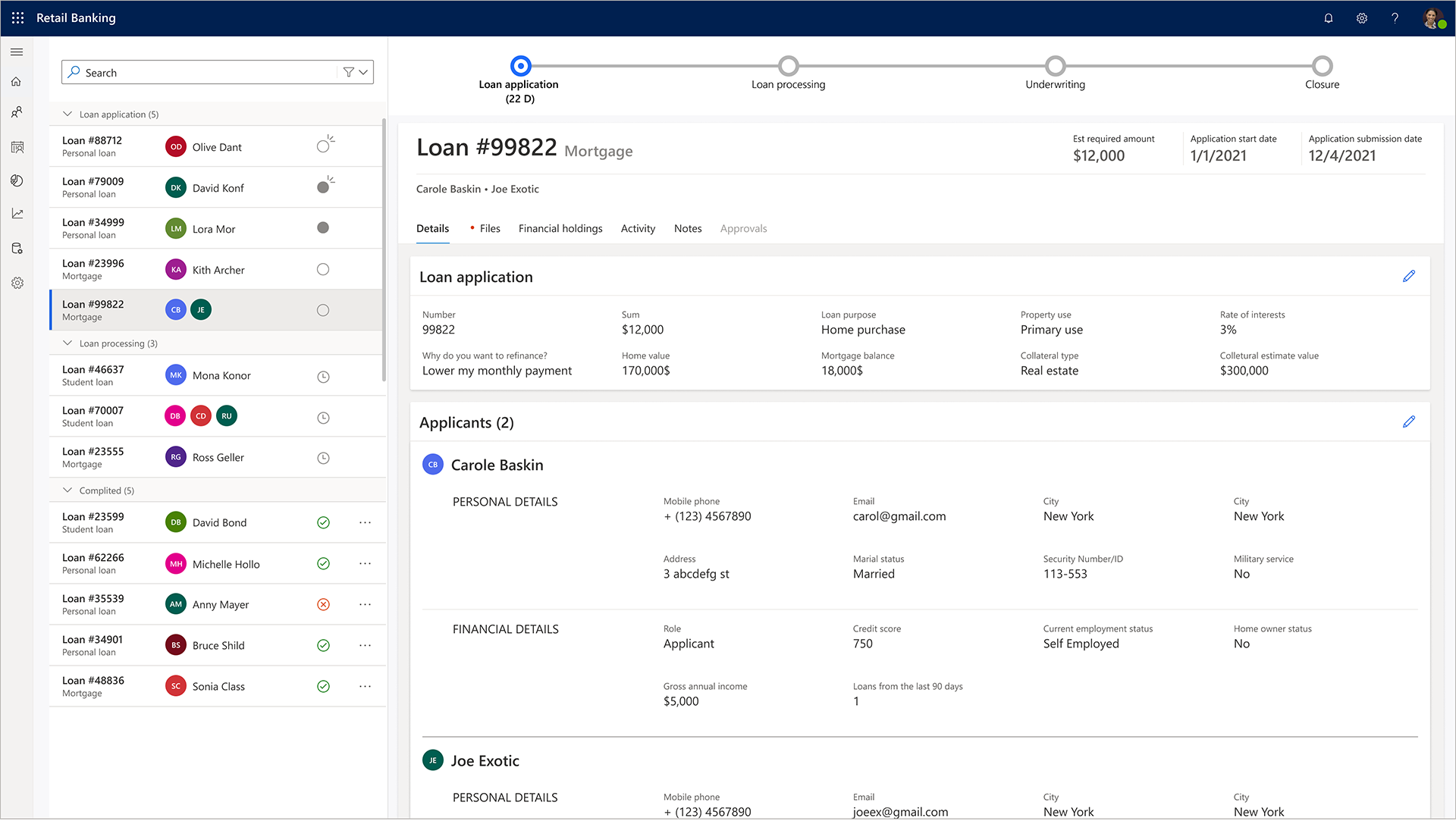

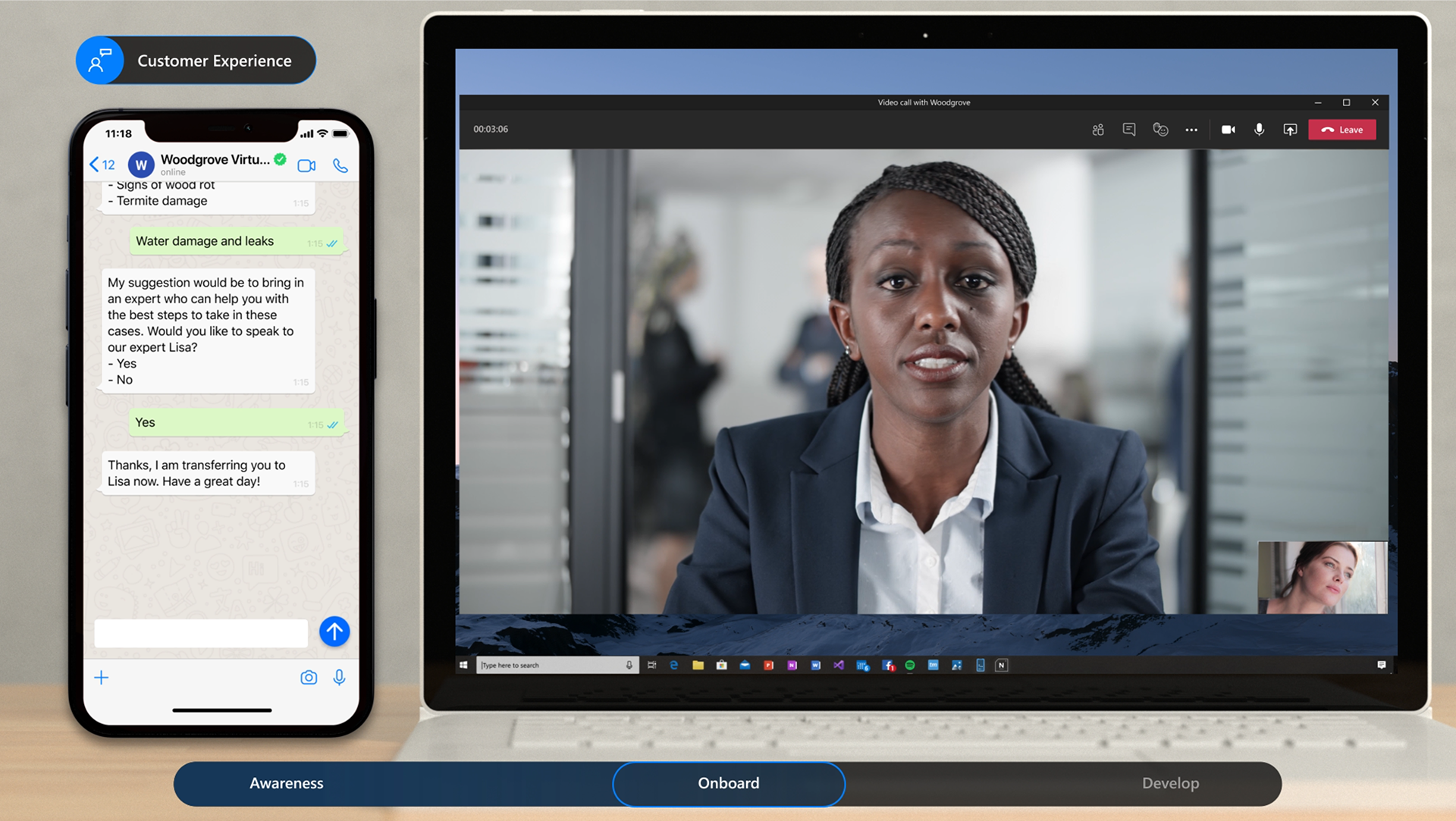

Customer Onboarding

Customer onboarding and loan processing are some of the key jobs to be done for any retail bank representative. We created a module designed to show a combined view of all loan applications, past and present, in order to provide the bank representatives with a master view and an accurate status of each loan application.

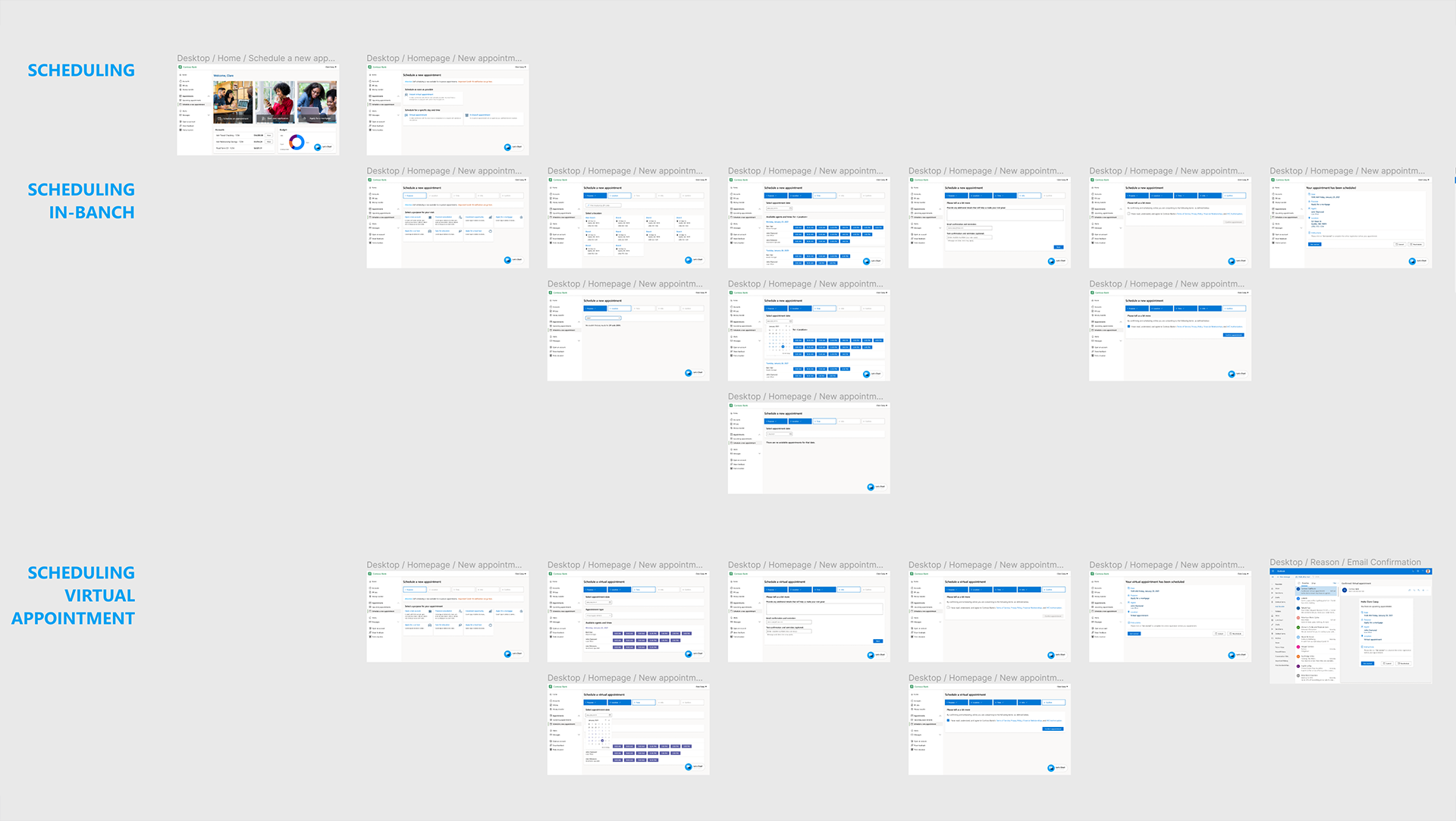

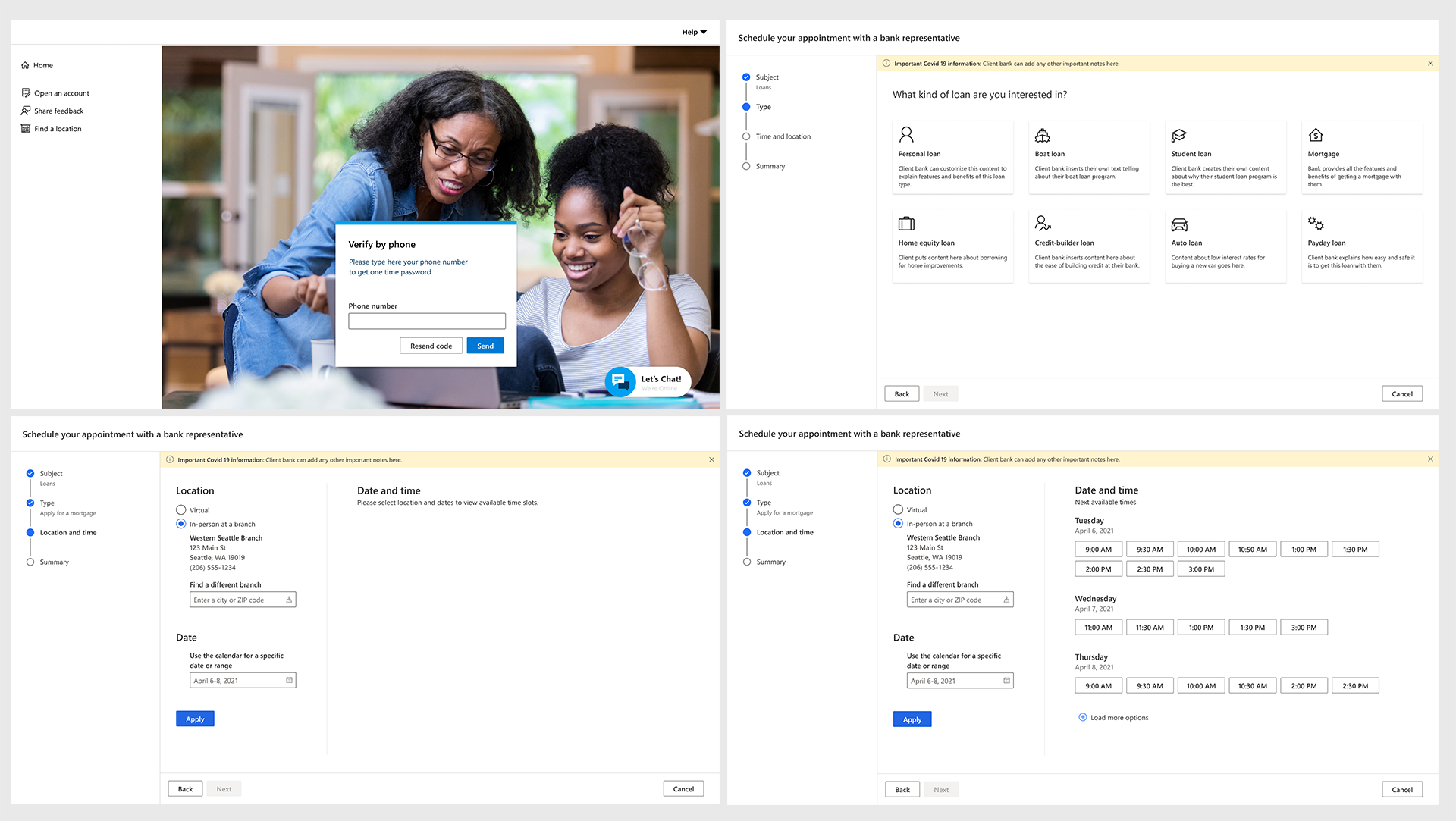

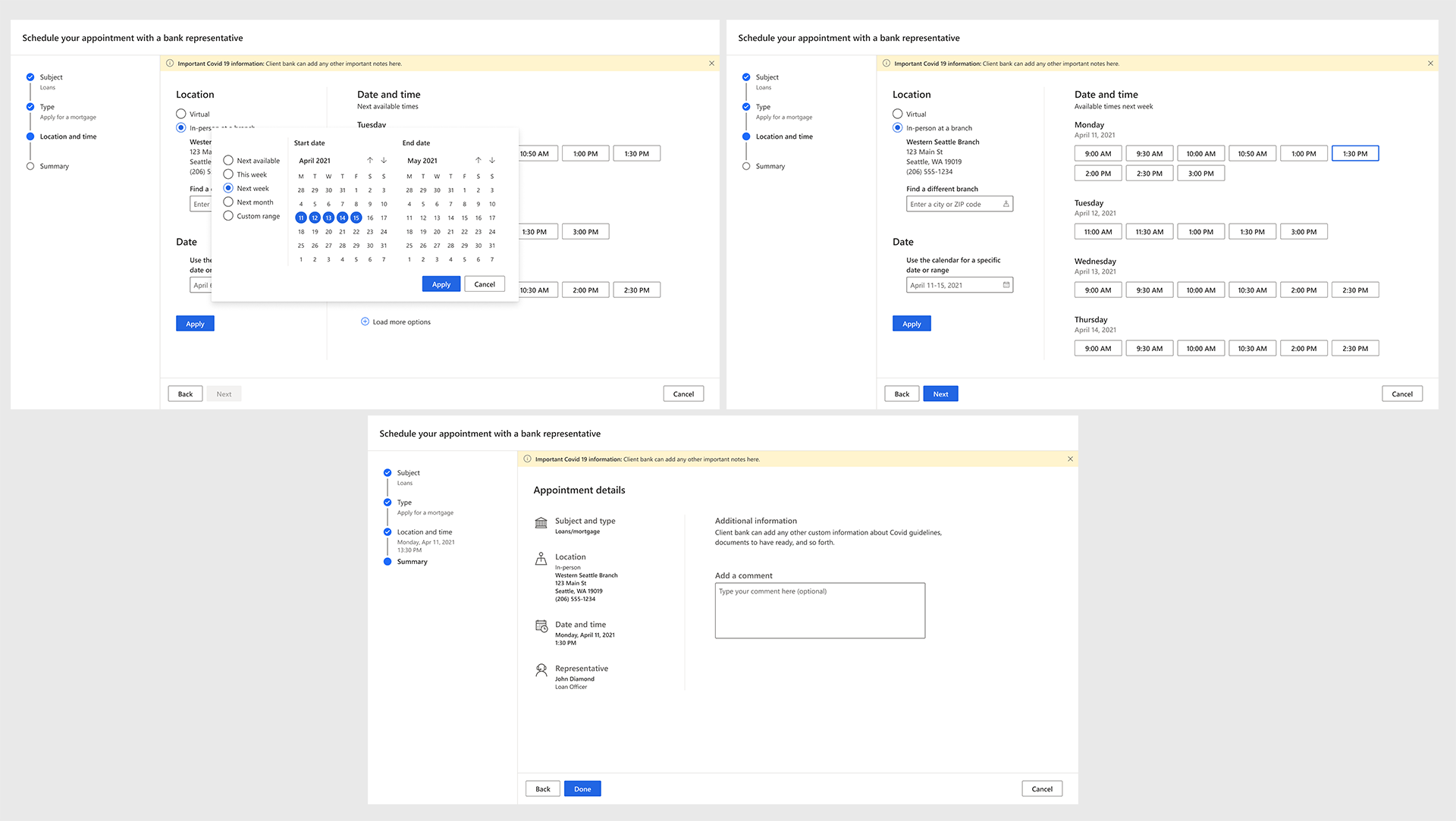

Intelligent Scheduling

The ability for customers to self-schedule appointments, based on their particular need and using the location and time of their choice – in person or virtual – is an important forward-first feature designed to provide retail banks with more ways to interact with customers in a changing world.

Where will this cloud solution go next? This vision casting video presents the possibilities.

Bringing together financial, behavioral, and demographic data to tailor customer experiences with a 360-degree view of the banking customer and suggested next actions..